GST Registration

Request A quote

Market Price

: ₹1800

Tax Panacea Price

: ₹999.00

You Save

: ₹801.00 (45%)

Government Fee

: Included

Complete By*

: 13-APR-2022

Complete Gst Guidance on Products and Services along with its Registration certificate.

Offers and discounts

Save 45% + 5% Additional Discount on Promocode PANACEAGST*

What is GST ?

GST (Goods and Services Tax) is an indirect tax implemented on the supply of goods and services in India. This tax is included in the final price and paid by the consumers at the point of sale and passed to the government by the seller. After the implementation of GST, the taxpayer base of India has extensively increased as it now includes millions of small businesses under one uniform tax system.

What is GSTIN?

GSTIN is a unique 15 digit code that is assigned to every taxpayer that has a legitimate GST Registration in India. The GSTIN code is issued to the taxpayer based on the state and the PAN. It is mandatory for any business that has an annual turnover of more than Rs. 20 lakh to have a GSTIN.

Who is eligible to obtain GST Registration?

Aggregate turnover

If a service provider is providing services of worth more than Rs. 20 lakh per year, then they are needed to get a GST Registration. However, if the turnover crosses the value of Rs. 40 lakh, then it is mandatory to get a GST Registration.

Interstate business.

An entity should get GST registration in India if they are supplying goods from one state to another. interstate Supply includes all goods transferring from one state to another which has monetary value attached to it.

E-Commerce Platform

Any individual that is supplying goods and services through E-Commerce in India should get a GST registration irrespective of their turnover, as it is mandatory for the commencement for an E-Commerce business.

Casual taxable person

Any individual who is starting a new business venture with the motive of supplying goods and services seasonally or through a temporary stall or shop is required to get a GST registration irrespective of the turnover.

Voluntary registration

Unlike earlier, an entity that wants to obtain a GST registration would not have to wait for a year to surrender, now the GST registration can be surrendered at any time by the applicant.

Documents required for GST Registration

- Latest electricity bill (of the premises where the GST registration is applied for).

- Latest telephone bill (of the premises where the GST registration is applied for).

- Latest property tax receipt (of the premises where the GST registration is applied for).

- Lease/ Rent agreement (if the property is rented or leased).

- Passport size photo of the authorized signatory under GST.

- Partnership deed (in case the applicant is a partnership firm).

- Incorporation Certificate (in case the applicant is a Company or a Limited Liability Partnership).

- PAN Card of the authorized signatory under GST.

- Aadhar card of the authorized signatory under GST.

- Consent letter (in case the property is taken by a person without rental agreement).

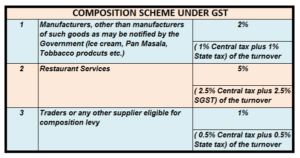

Composition Scheme under GST

The Composition Scheme under GST Act was introduced by the government to take some burden off the shoulders of small taxpayers. A taxpayer with a turnover of less than Rs. 10 crore can choose not to register as a normal taxpayer and could instead get registered under the composition scheme and enjoy the benefit of paying a nominal rate if taxes on the supplies. A taxpayer is not eligible to issue a tax invoice and also can’t utilize the input tax credit if they are registered under the Composition Scheme.

The taxpayers enjoy several benefits like limited compliance and limited tax liability by registering under the Composition Scheme.

Tax Computation Under Composition Scheme